“We don’t have any non-traveling family members. It’s just the two of us taking the trip. Everyone else is staying home and aren’t going on the trip with us. Why does it matter?”

I received this email response as an answer to “In the last 180 days, have any non-traveling family members had any medication changes or had treatment for, had symptoms of or been diagnosed with any medical condition that could worsen and, in turn, cause you to cancel or interrupt your trip?

I wasn’t sure how to respond to that without making them look stupid, so I only answered their question.

Why do my Non-Traveling Family Members matter?

Our trip insurance plans cover you for canceling or interrupting if you or they get ill or injured (i.e. – get hit by a cement truck).

In addition, it’s important to know about your Non-Traveling Family Members’ health because they might have some serious medical condition today that could worsen and cause you to cancel or interrupt your trip.

However, it’s possible (more likely in large families) that one of those Non-Traveling Family Members has a medical condition.

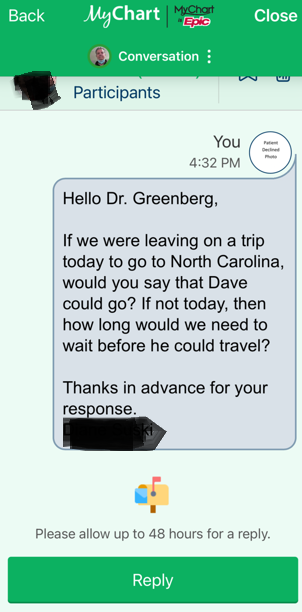

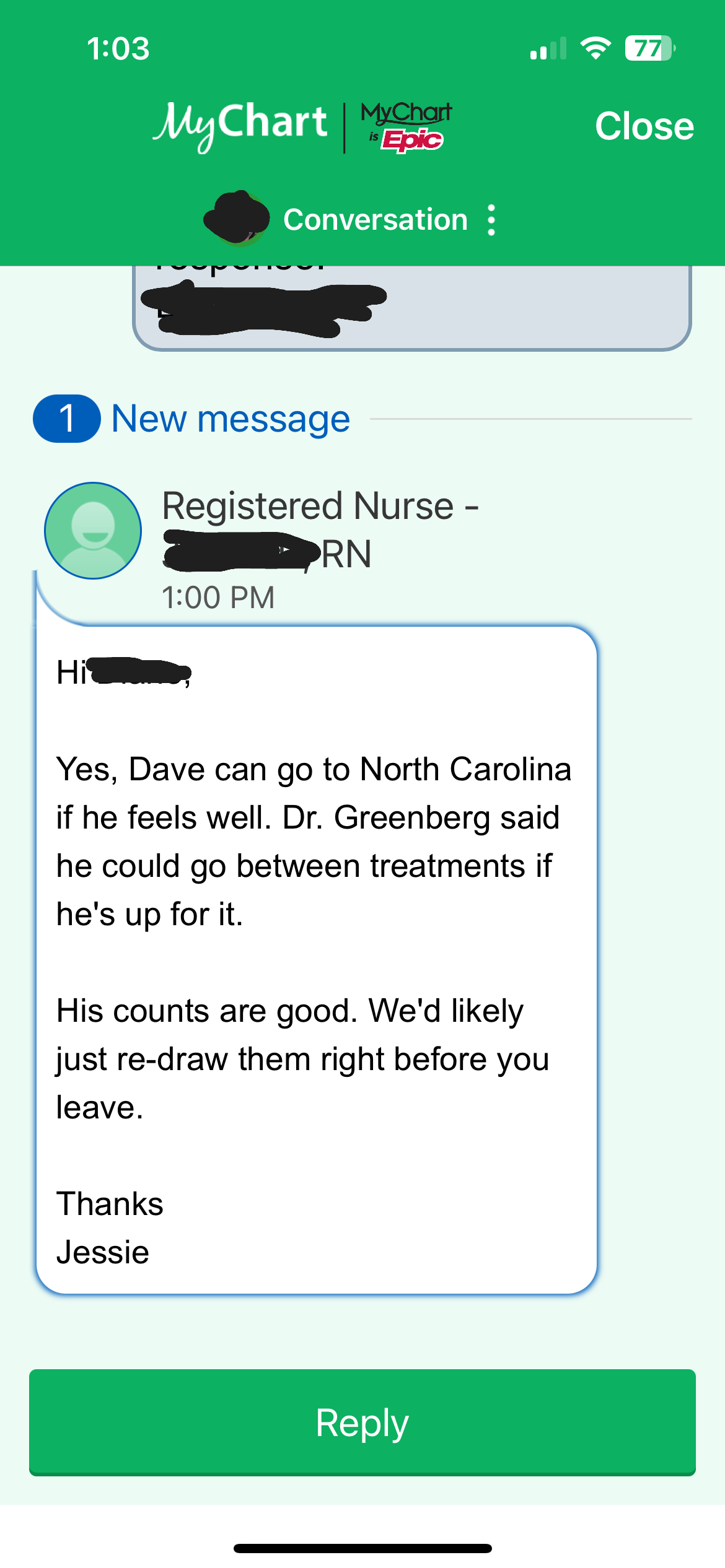

I’m 68 and my parents are 92 and 94. It’s a blessing that they are still around, but my Dad has pre-leukemia MDS (myelodysplastic syndrome). Because of this, when I buy Trip Cancellation insurance, I always get a plan that covers Pre-Existing Medical Conditions should my Dad’s health take a turn for the worse.

How is a Family Member Defined?

A Family Member usually means your spouse or domestic partner, child, spouse’s child, daughter-in-law, son-in-law, brother, sister, mother, father, grandparents, grandchild, step-brother, step-sister, step-parents, parents-in-law, brother-in-law, sister-in-law, aunt, uncle, niece, nephew, guardian, ward.

Now that you know about this, you also need to know that the vast majority of Trip Cancellation insurance plans require you to buy the plan within a short amount of time after your earliest payment of any kind toward any travel arrangements on your trip to have the “Waiver of the Pre-Existing Medical Condition Exclusion“.

That date is called the “Initial Trip Deposit Date” and any payment including taxes on frequent flier tickets or giving a credit card to guarantee a reservation counts as this date.

If your Initial Trip Deposit Date was more than 21 days ago, we have a few plans that always cover stable medical conditions of your non-traveling family member.

…

{ Comments on this entry are closed }

I hope this makes sense. If you want the right travel insurance advice, call us at 1-888-407-3854 and we'll help you figure it all out.

Now, a word from our sponsor: TripInsuranceStore.com (Travel Forums' Most Recommended Travel Insurance Website)

- Save your time & money with 9 pre-screened companies (you don't need 100+ travel or cruise insurance plans).

- You get personalized service at 1-888-407-3854. Or email us.

- Do you want a relationship with your travel insurance supplier? If so, you'll fit right in. If you'd rather not get to know us, you'll still find everything you need to get the right travel insurance plan.

- Get side-by-side plan & price comparisons

- You get our exclusive Smile of Satisfaction Money Back Guarantee