When a Trip Cancellation plan’s wording includes “You are medically able and not disabled from travel at the time Your premium is paid based on assessment of a Physician”, do I literally have to get a note from my doctor right now that says I am medically able and not disabled from travel before I buy the policy?

These are good and very timely questions. All Travel Insurance plans require you to be able to travel on the date you buy it.

Erroneously, most people think that the ability to travel only matters if you want the pre-existing medical condition coverage. However, the truth is that in order to be eligible to buy any travel insurance plan, you have to be able to travel on the date you buy it.

Nearly everyone is able to travel, but there are situations where that’s not the case. If any of these are true today, you aren’t able to travel:

- You are in the hospital now.

- If you recently got out of the hospital, you likely aren’t able to travel.

- You have specifically been told by your doctor you can’t travel.

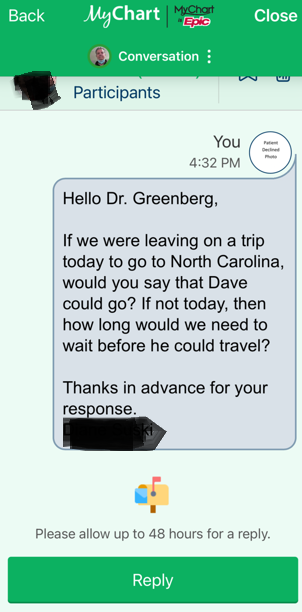

So, how do you document if you are able to travel? If you’re not sure, ask your doctor. If you have a Patient Portal, it’s best to send them a message so you have a document trail.

Here are screenshots from someone asking their doctor if Dave can travel today. The message was sent through the Patient Portal, so RN Jessie is who responded.

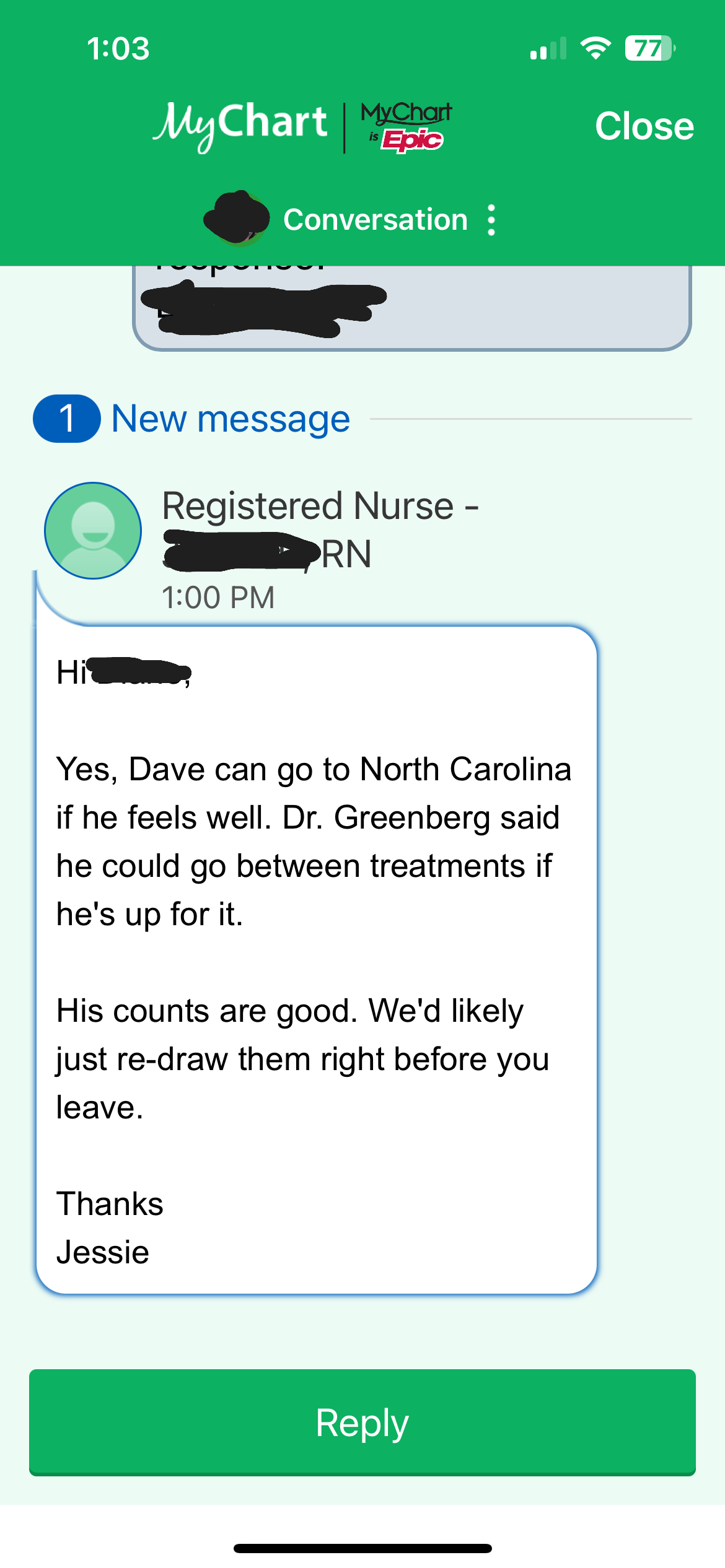

And, here’s Doctor Greenberg’s response via Jessie:

If Dave were to have any claim, they now have documentation he was able to travel.

Another reason to ask is if your doctor dies. I’ve seen this happen where someone’s being treated for a medical condition and after they received documentation that they were able to travel, before their trip, their doctor passed away. One of these people ended up with a large claim that was only paid because they had the documentation. Their new doctor wouldn’t certify his ability to travel because it was before knew each other.

{ Comments on this entry are closed }

I hope this makes sense. If you want the right travel insurance advice, call us at 1-888-407-3854 and we'll help you figure it all out.

Now, a word from our sponsor: TripInsuranceStore.com (Travel Forums' Most Recommended Travel Insurance Website)

- Save your time & money with 9 pre-screened companies (you don't need 100+ travel or cruise insurance plans).

- You get personalized service at 1-888-407-3854. Or email us.

- Do you want a relationship with your travel insurance supplier? If so, you'll fit right in. If you'd rather not get to know us, you'll still find everything you need to get the right travel insurance plan.

- Get side-by-side plan & price comparisons

- You get our exclusive Smile of Satisfaction Money Back Guarantee